Flipped houses are common in today’s real estate market. Many individuals have taken them on as DIY passion projects, and some companies have even created entire business models around them.

If you were to browse a listing for a flipped house, you’d likely find yourself in awe of their beautifully modern appeal. You may not even recognize that it was a flipped home and that it used to look much different a short while ago.

For these reasons, buying a flipped home can be a highly rewarding experience. However, there are some important things to be aware of before making that down payment. We’ll talk through them below.

What Is a Flipped House?

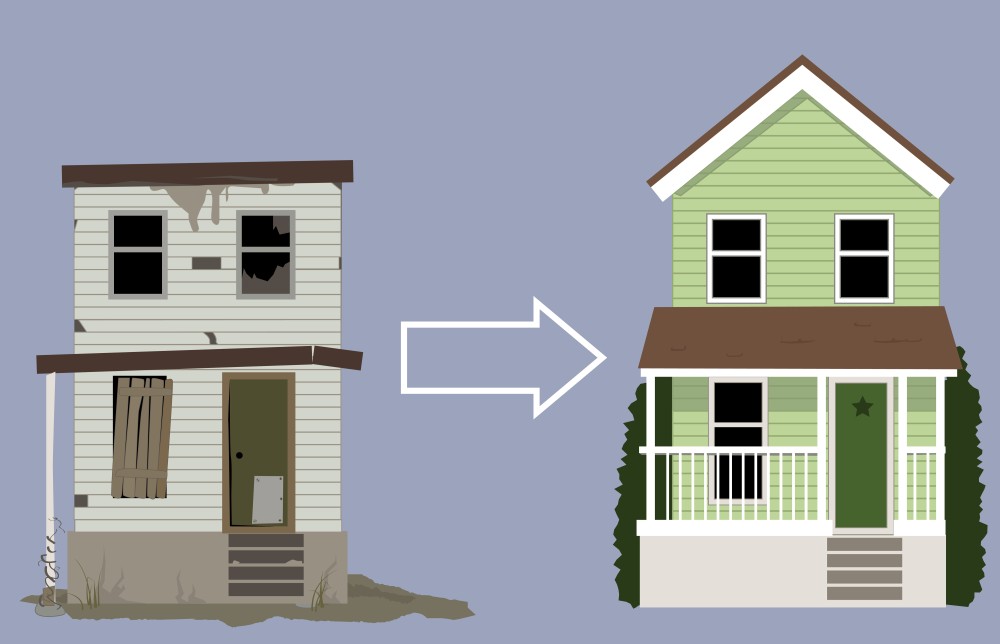

A flipped house is a house that someone (or some company) buys, renovates, and sells in hopes of making a profit. Before purchase and renovation, the house is generally in poor condition — something like what’s commonly referred to as a “fixer-upper.”

The results of house flipping are often impressive. The flippers take something that used to be outdated, damaged, and/or dysfunctional and turn it into a modern, livable space. This process is typically completed on a short timeline, too, with some house flips just taking a few months to a year.

Is Buying a Flipped House a Good Idea?

There is no all-inclusive answer to this question. It depends on the house at hand, as well as your specific needs and wants as a homeowner. The truth is that buying a flipped house could be one of the most rewarding or detrimental decisions a prospective homeowner can make.

In the following sections, we’ll discuss some of the advantages and disadvantages of buying a flipped house. This will help you know what to look out for and how to make the decision that are right for you and your family.

Advantages of Buying a Flipped House in West Michigan

Let’s start with the advantages. Under the right circumstances, buying a flipped house can be a great move. Here’s why.

- It’s move-in ready. Flipped houses are fully renovated (in most cases by professionals), so you won’t need to make any changes before moving in.

- It’s outfitted with modern appliances and finishes. The flipping process usually involves the installation of upgraded, modern appliances. You shouldn’t have to worry about anything not working properly for a long time.

- It comes with fewer contingencies. Since nobody is living in the home while it’s being renovated, there’s usually no delay in terms of when you can move in.

- It can be a more cost-effective option. A flipped house gives you the opportunity to have a newly renovated home without spending the time, energy, and money building one of your own.

Disadvantages of Buying a Flipped House in West Michigan

There are some risks to buying a flipped house as well. These aren’t relevant to every flipped house on the market but can pop up if you’re not buying from a trusted, professional home remodeling company. Here are a few things to look out for.

- Cosmetics may cover problems. Many house flippers are trustworthy and value good craftsmanship, but it is possible that some could be covering up large issues (e.g. structural damage or water damage) with cosmetic touch-ups.

- Renovations may not be compliant. There are many home renovations that require building permits. If the person or company who flipped the house didn’t obtain them, you’ll be responsible for bringing your home up to code.

- You don’t get to pick the design. If you have a particular design style in mind for your home, it may be best to build your own. Flipped houses are newly renovated, but may not match your exact style.

Questions to Ask Before Buying a Flipped House

To ensure you’re buying a flipped house you can trust to look beautiful and hold up for years, you may want to ask some questions before signing the contract. Here are a few that we suggest.

- Who renovated this house? How much renovation experience do they have? Do they have a license?

- What was the scope of work?

- Was the work properly permitted?

- How long did the renovation take?

- Which appliances and systems were replaced?

- Has the home undergone a professional inspection?

- Are there any warranties that come with the home?

By asking these questions, you can get more information on the history of the home and whoever renovated it. This may help clue you in on whether or not it’s a rewarding investment for you.

Buy a Flipped House From or Sell a Fixer-Upper To Hometown Development

Interested in buying a flipped house, or ready to sell your fixer-upper home? At Hometown Development, it’s our mission to purchase, revitalize, and sell homes in the West Michigan neighborhoods we love. Our team consists of construction professionals with great craftsmanship skills and a commitment to doing honest, quality work. We don’t take loopholes and try to sell homes we’re not proud of; we build with integrity.

As one of our area’s top real estate investment companies, we do the restoration dirty work so you can minimize your effort and maximize your investment. For more information on our process, contact our team.